Works of art have always been collected for their inherent

beauty, but many people also see them as potential assets to

include in their investment portfolios.

What’s the Market for

Art Collecting?

Art increasingly accounts for a larger proportion of individual wealth. Art in wealth portfolios is estimated at $1.5 trillion.

A Look at the 10,000 Most Valuable Artworks*

What’s the Market for

Art Collecting?

Art increasingly accounts for a larger proportion of individual wealth. Art in wealth portfolios is estimated at $1.5 trillion.

A Look at the 10,000 Most Valuable Artworks*

*As of Dec. 31, 2014

Sources:

Deloitte and ArtTactic's "Art & Finance Report 2014"

Skate's Top 10,000

The Growth in Auction Sales

Christie’s International and Sotheby’s, two of the world’s largest auction houses, have experienced compounded annual growth rates of 14.9 percent in art sales since 2000. In 2014, the two houses sold nearly $14 billion in art and reported double-digit increases in sales over 2013.

Auction sales by category*

$0.3 | Old Masters

$0.5 | Impressionist and Modern

$0.3 | Contemporary

$0.2 | Old Masters

$1.2 | Impressionist and Modern

$0.6 | Contemporary

$0.4 | Old Masters

$2.3 | Impressionist and Modern

$2.6 | Contemporary

$0.5 | Old Masters

$1.9 | Impressionist and Modern

$2.7 | Contemporary

$0.8 | Old Masters

$2.7 | Impressionist and Modern

$4.5 | Contemporary

and

Modern

*Christie's and Sotheby's

Sources:

Christie's and Sotheby's, and The Fine Art Fund Group

Who’s Collecting What?

Just what does the average art collector look like?

59

59YEARS Average age

Who’s Collecting What?

Just what does the average art collector look like?

59

59YEARS

Sources:

Larry's List Art Collector Report 2014

AXA ART's "Collecting in the Digital Age

International Collectors Survey"

Sources:

Larry's List Art Collector Report 2014

AXA ART's "Collecting in the Digital Age International Collectors Survey"

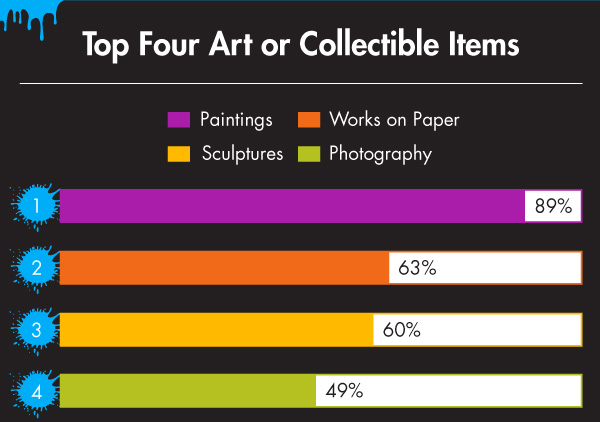

Top Four Art or Collectible Items

Paintings

Paintings

Works on Paper

Works on Paper

Sculptures

Sculptures

Photography

Photography

Source:

AXA ART's "Collecting in the Digital Age International Collectors Survey"

Popular Artists of 2014

Number of Auction Trades in 2014

Auction Trading Volume in 2014

Number of Repeat Sales in 2014

| Pablo Picasso | 58 |

| Andy Warhol | 55 |

| Jean-Michel Basquiat | 22 |

| Gerhard Richter | 22 |

| Claude Monet | 21 |

| Andy Warhol | $560,435,539 |

| Pablo Picasso | $345,101,066 |

| Francis Bacon | $302,129,191 |

| Gerhard Richter | $266,038,311 |

| Claude Monet | $246,884,473 |

| Pablo Picasso | 18 |

| Andy Warhol | 17 |

| Claude Monet | 11 |

| Jean-Michel Basquiat | 9 |

| Gerhard Richter | 7 |

| Pablo Picasso | 58 |

| Andy Warhol | 55 |

| Jean-Michel Basquiat | 22 |

| Gerhard Richter | 22 |

| Claude Monet | 21 |

| Andy Warhol | $560,435,539 |

| Pablo Picasso | $345,101,066 |

| Francis Bacon | $302,129,191 |

| Gerhard Richter | $266,038,311 |

| Claude Monet | $246,884,473 |

| Pablo Picasso | 18 |

| Andy Warhol | 17 |

| Claude Monet | 11 |

| Jean-Michel Basquiat | 9 |

| Gerhard Richter | 7 |

Source:

Skate’s Top 10,000

Why Do They Collect?

While just 3% of collectors buy art for purely investment purposes, 76% purchase for collecting purposes but with an investment view. Art professionals say their clients collect art for a number of reasons.

Motivations for Purchasing by Art Professionals

Emotional Value

Emotional Value  Social Value

Social Value  Luxury Good

Luxury Good

Personal Diversification

Personal Diversification  Investment Returns

Investment Returns

Inflation Hedge

Inflation Hedge  Safe Haven

Safe Haven

Emotional Value

Emotional Value  Social Value

Social Value

Luxury Good

Luxury Good  Personal Diversification

Personal Diversification

Investment Returns

Investment Returns  Inflation Hedge

Inflation Hedge

Safe Haven

Safe Haven

Source:

Deloitte and ArtTactic's

"Art & Finance Report 2014"

Source:

Deloitte and ArtTactic's "Art & Finance Report 2014"

Key Takeaways

“The aim of art is to represent not the outward appearance of things, but their inward significance,” Aristotle said. Today, art also can have significance in an investment portfolio.

Art and collectibles increasingly account for a larger proportion of individual wealth, and as a result, many wealth managers look at art as a potential strategic asset.

Although large gains in value for works of art often receive attention in the press, new collectors should not expect to see major returns, especially in the near-term. As you begin to collect, think of art as personal property, something you purchase to enjoy as a part of your daily life, regardless of market fluctuations.

© 2015 Northern Trust Corporation

The views, opinions and investment information expressed are those of the individuals noted herein, do not necessarily represent the views of Northern Trust or any other person in the Northern Trust organization and are subject to change based on market or other conditions. The material is provided for informational purposes only and should not be construed as investment, tax or legal advice or a recommendation to buy or sell a security. Northern Trust disclaims any responsibility to update such views. Northern Trust does not guarantee that the information supplied is accurate, complete or timely and does not make any warranties with regard to the results obtained from its use. Northern Trust does not guarantee the suitability or potential value of any particular investment or information source. You should consult your investment, tax, legal and accounting professionals before taking any action. Past performance is not indicative of future results.

To ensure compliance with requirements imposed by the Internal Revenue Service, we inform you that any tax information in this magazine is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.